More Than Just Protection: How Indexed Universal Life with Long-Term Care Can Help You Live Better

Most people think of life insurance as something that only benefits their loved ones after they’re gone. But what if your policy could do more?

With Indexed Universal Life (IUL) insurance featuring Long-Term Care (LTC) benefits, you can create a tax-free financial safety net that works for you while you’re alive, helping you enjoy a more secure, stress-free retirement.

🔹 Why Think Beyond Traditional Life Insurance?

Unlike traditional life insurance, which only provides a death benefit (or what we like to call a Legacy Benefit), IUL with LTC offers living benefits you can access when you need them most.

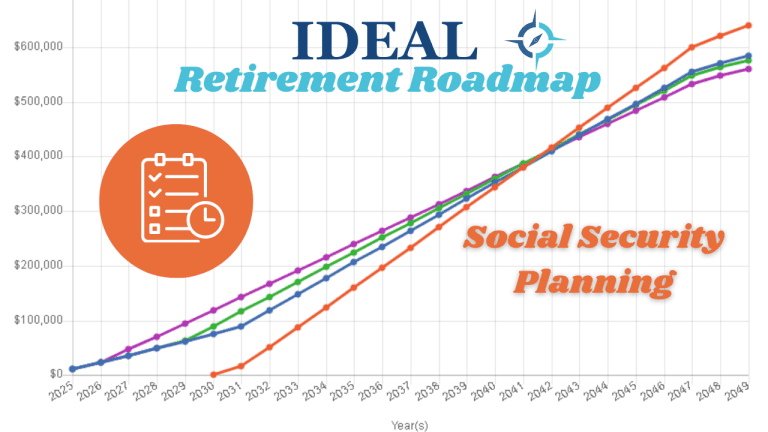

✅ Tax-Free Retirement Income – Supplement your savings without increasing your taxable income.

✅ Long-Term Care Protection – Cover nursing home, assisted living, or in-home care costs if needed.

✅ Wealth Growth with Market Protection – Enjoy stock market gains without the risk of losses.

✅ Estate Protection & Wealth Transfer – Leave a tax-free legacy for your loved ones.

🔹 How Can This Help You Live a Better Life?

Imagine having a financial cushion that allows you to:

✔️ Retire with confidence, knowing you have a guaranteed source of income.

✔️ Access funds if you face unexpected medical or long-term care expenses.

✔️ Protect your family’s future without sacrificing your own quality of life.

This isn’t just about planning for the “what if’s”, it’s about creating peace of mind and financial freedom for the years ahead.

🔹 Is This Right for You? Let’s Find Out!

Everyone’s financial situation is unique. That’s why I’m offering a FREE Financial Needs Analysis to help you determine if IUL with LTC is the right fit for your retirement plan.

📞 Call or text David Westgate today at 774-855-6600 to schedule your strategy session and start building a retirement that works for YOU!